ICFiles

SOC 2

Secure File Transfer Soc 2 starts at $1 per month

How Will Increased Tapering Impact Markets in 2022?

Stock Market News

January, 2022

Get this Article Get this Article & Suite of Tools

How Will Increased Tapering Impact Markets in 2022?

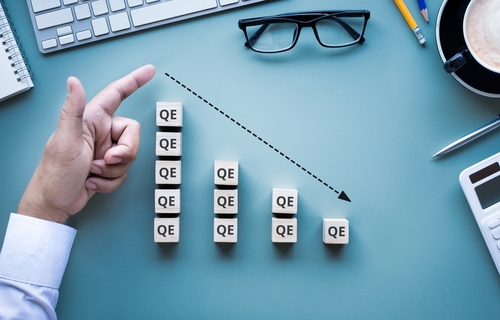

According to a Dec. 15 Federal Open Market Committee (FOMC) statement from the Federal Reserve, the federal funds target range will remain at 0 percent to 0.25 percent. Beginning in January, the FOMC will reduce its monthly purchase of assets to $40 billion in Treasury securities and $20 billion in mortgage-backed securities, with tapering expected to finish well before mid-2022. The FOMC also projects three rate hikes in 2022. These monetary policy adjustments are all subject to change based on the economic developments going forward, signifying uncertainty for markets in 2022.

According to a Dec. 15 Federal Open Market Committee (FOMC) statement from the Federal Reserve, the federal funds target range will remain at 0 percent to 0.25 percent. Beginning in January, the FOMC will reduce its monthly purchase of assets to $40 billion in Treasury securities and $20 billion in mortgage-backed securities, with tapering expected to finish well before mid-2022. The FOMC also projects three rate hikes in 2022. These monetary policy adjustments are all subject to change based on the economic developments going forward, signifying uncertainty for markets in 2022.

What History Says

Looking back to the last “taper tantrum” in 2013 when Ben Bernanke was in charge of the Federal Reserve, equities lost 5.8 percent during June 2013 (similar to the decline in markets during September 2021). While many considered this a “market pullback,” the S&P 500 saw gains of 17.5 percent for the rest of 2013. Looking from WWII onward, there’s been 60 instances of the stock market falling initially by 5 percent to 6 percent, but the next month it was up 3.3 percent on average, and 92 percent being higher by year-end.

From the second half of December 2013 through October 2014, the S&P 500 advanced 11.5 percent, primarily because Wall Street was confident in the economy’s health in growing with the Fed’s bond-buying.

After the rallying months, markets have gained an average of 8.4 percent 100 days later. For the 2021-2022 cycle, the rally is expected to go through January 2022. However, historical S&P 500 trends suggest volatility and a drop of 5 percent or greater in February 2022. February is generally the second worst month of the year for market performance.

What’s Happening this Cycle

Fed Chair Powell clearly indicated that rates are to be raised soon and inflation is expected to stabilize. Inflation is expected to hit 6 percent in Q4 of 2021, and trading on Wall Street is expected to see bearish trends to start 2022.

Since the Fed has been crystal clear about tapering, such communication has likely resulted in a relatively smoother transition for the markets. According to the Board of Governors of the Federal Reserve System, quantitative easing (QE) began in 2008 due to the financial crisis, was rolled back at the end of 2018, but the Fed became more accommodative again during the COVID-19 crisis. As of October 2021, the Fed’s balance sheet was $8.5 trillion. This was double what the Fed’s balance sheet was in early 2020 and 10 times as large from mid-2007 levels of $870 billion.

With Powell yet to be reconfirmed for a second term, there is uncertainty, along with the 2022 mid-term elections and pressure from progressive politicians looking for a dovish Fed chair.

Powell’s comments at the recent FOMC meeting explained that once COVID-caused jams to the supply chain are resolved, inflation will subside. This perspective, paired with his continual observation of the economy and flexibility on raising rates, has become a tug-of-war between the Fed and Wall Street investors on market performance. The Fed also indicated that once the bond-buying is complete, it’s not an automatic trigger for interest rate hikes. However, depending on how inflation plays out, the market will have its own interpretation of how the Fed will react to unfolding inflation.

Putting the Fed’s Moves Into Perspective

QE and lowering the Fed funds rate both can be effective monetary policy. QE helps when the Fed increases its balance sheet by buying long-maturity bonds and mortgage-back securities to drive lower yields. Lower interest rates enable cheaper borrowing, which can help the economy grow employment and increase growth. If QE is rolled back, there will be uncertainty over whether the economy can stand on its own two feet.

The true question of the potential impact on markets is whether the Fed will taper only or also reduce its balance sheet holdings. Other ways the Fed can tighten monetary policy is by adjusting short-term interest rates via the discount window/federal funds rate. The Fed similarly can sell assets from its balance sheet via open market operations (OMO).

Get this Article Get this Article & Suite of Tools

These articles are intended to provide general resources for the tax and accounting needs of small businesses and individuals. Service2Client LLC is the author, but is not engaged in rendering specific legal, accounting, financial or professional advice. Service2Client LLC makes no representation that the recommendations of Service2Client LLC will achieve any result. The NSAD has not reviewed any of the Service2Client LLC content. Readers are encouraged to contact their CPA regarding the topics in these articles.

Dynamic Content Powered by Service2client.com

SEO Content Powered by DynamicPost.net